ad valorem property tax florida

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both. Ad Valorem and Non-Ad Valorem Calendar.

Property Taxes Highlands County Tax Collector

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant.

. Ad Search Property Tax Records from Home Without Lines or Paperwork. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments. Enter the Address Here.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. PDF 324 KB PT-111111. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

You may also be part of a special district or assessment boundary that has different taxes than. Search For Title Tax Pre-Foreclosure Info Today. Taxing Authorities and Non-Ad.

Ad valorem taxes are. In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Register now to begin the first step of determining your.

What is ad valorem tax. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Florida Property Tax Calendar Typical Year.

Property ad valorem taxesie. Authorized by Florida Statute 1961995. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. Florida property taxes vary by county. What is ad valorem tax exemption Florida.

Property Tax Oversight Program. The Florida Homeowner Assistance Fund may be able to offer you relief for mortgage payments and other homeowner expenses. Property tax can be one of the.

Some counties use only or nearly only valorem taxes. The most common ad valorem taxes are property taxes levied on real estate. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

View the Full Range of County Assessor Records on Any Local Property. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Real property is located in described geographic areas designated as parcels.

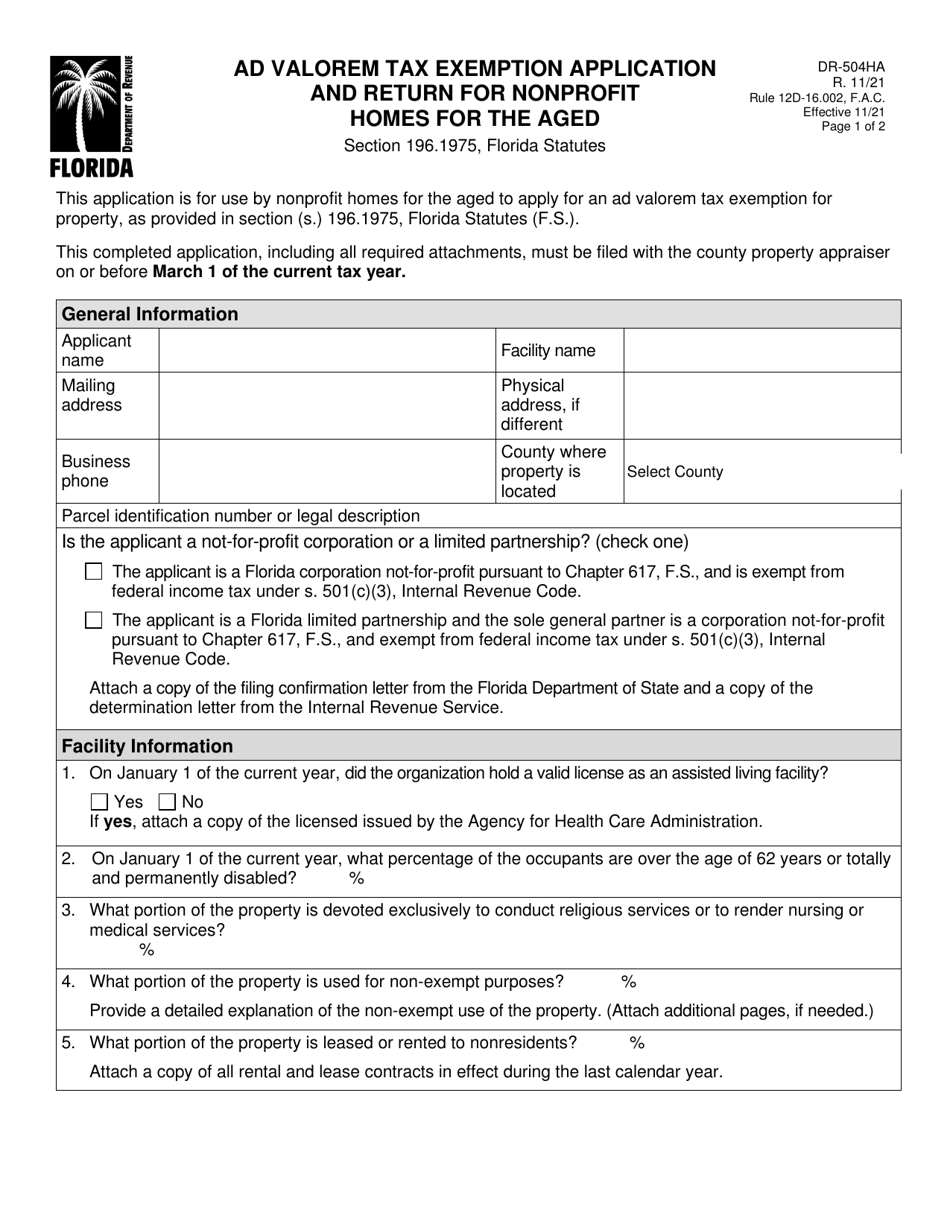

Officer charged with the collection of ad valorem taxes levied by the county the school board. What is an example of an ad valorem tax. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS.

Under Florida law anyone entitled to claim a homestead exemption may be eligible to defer payments of property taxes and non-ad valorem assessments based on household income. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida. These tax statements are mailed out on or.

The most common ad valorem taxes are property taxes levied. The Real Estate Tax Notice is a combined notice of Ad Valorem. A Levy means the imposition of a non-ad valorem.

The greater the value the higher the. The most common ad. The 2022 Florida Statutes.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Valorem taxes are based on the property value less any exemptions granted multiplied by the applicable millage rate. PDF 21 MB PT-111112.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal propertyThe most common ad valorem taxes are property. The Latin phrase ad valorem means according to value. Ad valorem means based on value.

Search Any Address 2. Property taxesare usually levied by local jurisdictions such as counties or school districts. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

It includes land building fixtures and improvements to the land. See Property Records Tax Titles Owner Info More. The tangible tax bill is only for ad valorem taxes.

455 65 votes. Be Your Own Property Detective. Florida Department of Revenue.

Property Taxes Expected To Spike For New Homeowners

Broward County Property Taxes What You May Not Know

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Homestead Exemption Template Real Estate Agent Etsy Home Buying Checklist Real Estate Checklist Real Estate Agent

Understanding Your Tax Bill Seminole County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Entrepreneurship Is Living A Few Years Of Your Life Like Most People Won T So That You Can Spend The Rest Of Your Life Like Mos Business Lawyer Life Business

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Real Estate Property Tax Constitutional Tax Collector

Explaining The Tax Bill For Copb

A Guide To Your Property Tax Bill Alachua County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)